Make your investment successful with our local expert

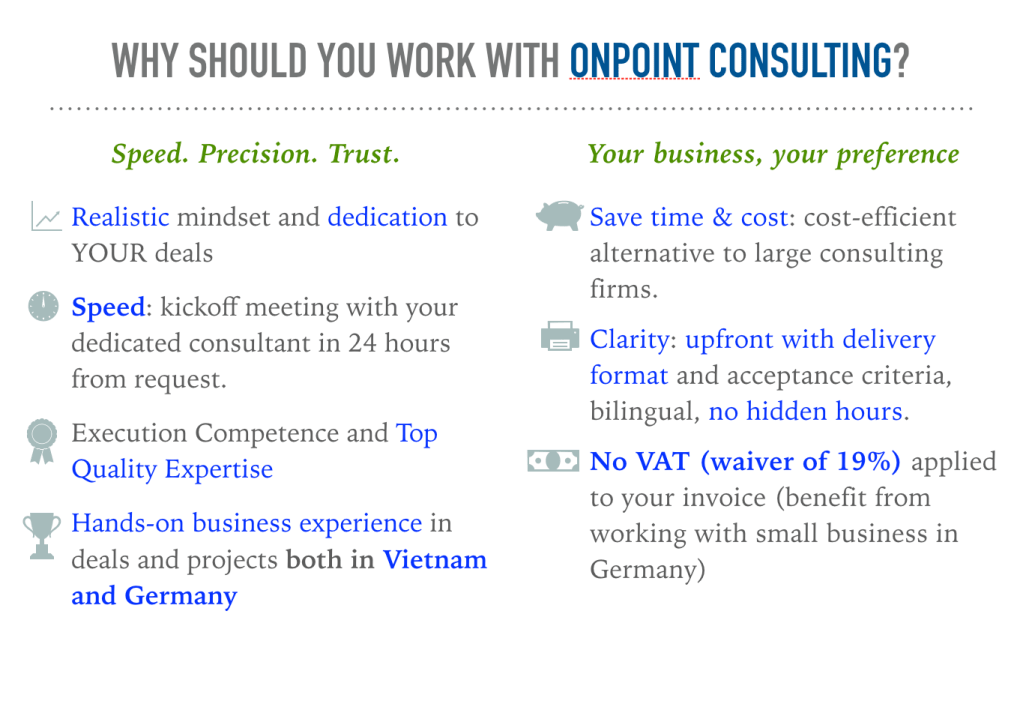

Our firm delivers fast, precise, and reliable advice on investments and deals between Vietnam and Germany, enabling you to grow your business with confidence and efficiency.

Our Expert

Hau Pham

Hau possesses extensive expertise in business deals, partnerships, contracts, and cross-border business expansion between Vietnam and Germany. With a strong background in M&A, partnerships, commercial negotiations, and the Vietnamese legal landscape, she helps clients achieve results promptly and efficiently.

Connect with Hau to experience dedicated service, hands-on expertise, and practical, actionable advice for your business.

Email: hau@onpointbyhau.com

Mobile and WhatsApp:

+49 151 6502 4499

Zalo: +84 908 846 500

Address: In der Clamm 36, 68766 Hockenheim, Germany

MEET HAU PHAM, THE CONSULTANT

Empowering Vietnam–Germany Business Success through OnPoint Consulting

As founder of OnPoint Consulting, I enable German and Vietnamese businesses to succeed in both markets by leveraging my background in Vietnam and my extensive professional experience in Germany. My career began in 2012 as a commercial and M&A lawyer with top international and regional firms, including Allen & Overy (now A&O Shearman) and Rajah & Tann. In 2020, after relocating to Germany and shifting from legal practice to strategy and business management, I developed a broader, commercially focused perspective.

With a Master’s in EU Business Law from the University of Mannheim, I advanced to Strategic Sales Project Manager at ProMinent GmbH, supporting global sales and partnership expansion in industrial water treatment. Since 2023, I join AUMOVIO (formerly Continental Automotive), a DAX-listed leader in autonomous mobility and advanced vehicle technologies, as Partnership Contract Manager.

My experience in Germany’s corporate environment taught me that sustainable business success extends beyond regulations and contracts; it hinges on effective sales, strong partnerships, and profitability. This cross-market expertise enables me to bridge business opportunities between Vietnam and Germany, empowering small businesses to expand confidently across borders.

Through OnPoint Consulting, I advise German and Vietnamese clients on strategy, partnerships, and cross-border operations, underpinned by robust networks in both countries. My consulting practice operates at the intersection of law, business strategy, and international trade.

I am dedicated to structuring and driving deals, supporting market expansion, and enabling partnerships that deliver measurable results. Having championed foreign investment and international cooperation throughout my career, I take pride in helping strengthen trade and investment ties between Vietnam and Germany. For clients seeking flexibility, quality, and results, OnPoint Consulting offers top quality, dedication and precise execution.

Let’s discuss your project!

On a personal note, I am 35 years old. Outside of work, I am a marathon runner and an artisan baker. I enjoy bringing people and ideas together to foster business success.

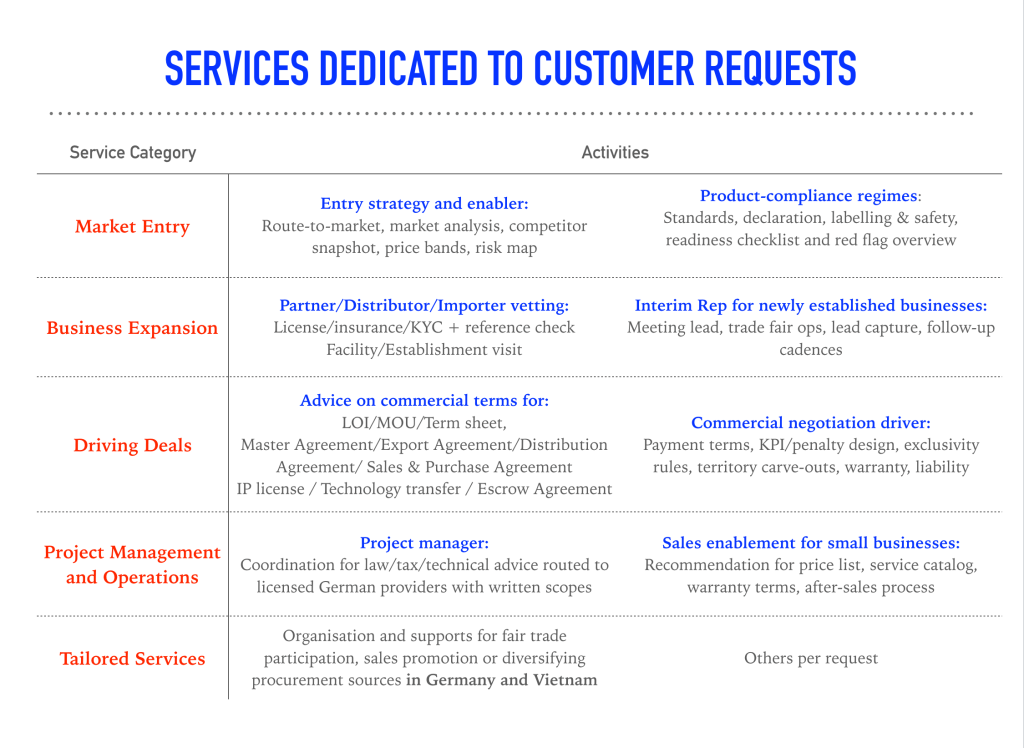

Our services

Market Entry: work with us to enter new markets smoothly and effectively.

Business Expansion: expand your business between Vietnam and Germany with our strategic advice and local expertise.

Mergers and acquisitions (M&A): get our strategic advisory, commercial transactions, process management, deal and contract coordination.

Deals Driving: get our help for recommendations and advice on commercial terms, design commercial package, negotiate contract and manage signing.

Project Management: select us as your internal advisor to work on your behalf with your mandated legal and tax firms.

Vietnam Market Update for German businesses

Vietnam was added to the EU list of non-cooperative jurisdictions for tax purposes

24 February 2026

Content is provided for general informational purposes only and does not constitute legal, tax, accounting, or investment advice. It does not take into account any individual circumstances. Readers should obtain advice from qualified professional advisers before making any business, legal, or tax decisions.

Update based on EU Council’s press release regarding EU list of non-cooperative jurisdictions for tax purposes

On 17 February 2026, the Council adopted the EU list of non-cooperative jurisdictions for tax purposes. Vietnam is one of the 10 countries on the list. To be considered cooperative for tax purposes, jurisdictions are screened on a number of criteria, established by the Council. The listing criteria relate to: tax transparency, fair taxation and measures against base erosion and profit shifting (‘anti-BEPS measures’).

Viet Nam was included in the EU list after the OECD Global Forum’s review revealed that the country did not meet the necessary standards for the exchange of tax information on request.

Since it was first established in 2017, the list has been updated regularly and revised as a result of dynamic monitoring of the measures implemented by jurisdictions to comply with their commitments. The list is to be updated twice a year. The latest revision took place in February 2026. The next revision is due in October 2026.

The Council announced that their aim with this list is to encourage positive change in their tax legislation and practices through cooperation. Once a jurisdiction meets all its commitments, its name is removed from the list.

In principle, the EU cannot and does not impose taxes on citizens or companies. For the EU list to be effective, it is important that EU member states put in place efficient defensive measures in non-tax and tax areas. Defensive measures help to protect EU member states’ tax revenues and fight against tax fraud, evasion and abuse. EU member states have broad discretion over the type and scope of defensive measures they apply in the tax area. These largely depend on their national tax systems. Nevertheless, there is a certain degree of coordination within the EU.

Observations (Germany-focused, indicative only):

For German groups with operations in Vietnam, the EU listing may lead to increased tax and compliance scrutiny and—depending on German implementation and effective dates under Germany’s defensive tax framework (e.g., the Tax Haven Defence rules)—potential measures such as stricter CFC / Hinzurechnungsbesteuerung for certain low-taxed subsidiary income, expanded withholding tax obligations for specific payment types, limitations affecting participation exemptions on dividends/capital gains, and restrictions on deductibility of certain expenses. The applicability, scope, and timing depend on the specific facts, payment streams, and the relevant German rules in force at the time.

Vietnam accedes to the Hague Apostille Convention (1961) – potential administrative efficiency in cross-border transactions

15 February 2026

Vietnam has acceded to the Hague Apostille Convention, a development expected to enhance cross-border administrative efficiency for businesses and individuals. Germany is currently a member to the Hague Apostille Convention (1961).

Once in force, the Convention will replace the consular legalization step for qualifying public documents exchanged between Vietnam and other Convention member states. Instead of multi-layer authentication involving embassies or consulates, a single Apostille certificate issued by a designated competent authority will be sufficient.

Practical implications:

(i) Reduced procedural steps in cross-border documentation,

(ii) Shorter processing timelines, and

(iii) Lower authentication-related administrative costs.

This is particularly relevant for corporate documents, powers of attorney, commercial registrations, and certain personal status documents used in international investment, M&A, and regulatory filings.

Timing and implementation:

The Convention will take effect between Vietnam and other member states that do not object to Vietnam’s accession as of 11 September 2026. Vietnam has designated the Ministry of Foreign Affairs as the competent authority to issue Apostille certificates, including: the Consular Department (headquartered in Hanoi) and the Ho Chi Minh City Department of External Relations (Cục Lãnh sự (trụ sở tại Hà Nội) và Sở Ngoại vụ thành phố Hồ Chí Minh). However, detailed domestic implementation is still expected. Practical application will depend on these implementing measures.

Further updates will follow once Vietnam issues more concrete regulatory guidance clarifying scope, procedures, and operational details.

Regulatory & Tax Changes Affecting Foreign SMEs in Vietnam

02 Jan 2026

Vietnam remains attractive for German SMEs, but the regulatory and tax environment has become noticeably stricter. Authorities have tightened rules on transfer pricing and related-party transactions, lowering tolerance for informal intercompany arrangements and incomplete documentation. This shift is no longer limited to large multinationals—foreign-invested SMEs are increasingly subject to tax audits, particularly in areas such as service fees, management charges, and profit allocation.

At the same time, companies face closer scrutiny on VAT refunds, withholding tax, and permanent establishment (PE) risks. German firms providing services remotely or through short-term personnel in Vietnam are more frequently challenged on whether their activities trigger local tax obligations. Parallel to this, Vietnam’s tax administration is rapidly digitalizing, with mandatory e-invoicing and enhanced data cross-checking significantly increasing transparency and audit efficiency.

Bottom line for German SMEs: Vietnam is still business-friendly, but compliance expectations have risen sharply. Early investment in proper accounting, robust contracts, and defensible intercompany pricing is no longer optional—it is essential to control risk and avoid costly disputes later.

Vietnam’s Role in Supply Chain Diversification for the German Mittelstand

02 Jan 2026

Vietnam continues to strengthen its position as a key manufacturing and sourcing hub for German SMEs as part of China+N strategies. Competitive labor costs, tarade agreements, and a growing supplier base make Vietnam attractive for electronics, machinery components, textiles, and consumer goods.

However, SMEs face practical constraints: shortages of skilled labor, infrastructure pressure in industrial zones, and uneven compliance standards among local suppliers. In addition, legal and tax risks in contract manufacturing, OEM/ODM models, and tooling ownership are often underestimated and can lead to loss of IP or unexpected tax exposure. ESG and supply-chain due diligence expectations from Germany are also rising and increasingly enforced through customer audits.

Key takeaway: Vietnam offers real opportunities, but success now depends on strong supplier governance, clear contracts, and disciplined risk management, not cost arbitrage alone.

German Market Update for Vietnamese businesses

Germany Coffee Market for Vietnamese Producers

1 Feb 2026

- Market Size & Importance

Germany is the largest coffee market in Europe and one of the top global hubs for coffee trade and processing.

According to Deutscher Kaffeeverband (German Coffee Association), Germany imports ~1.2–1.3 million tonnes of coffee per year (mostly green coffee).

Average amount consumed per person: ~163 liters/year, among the highest globally.

Global context:

Largest coffee consumer by volume: USA, Germany ranks top 5 worldwide and #1 in Europe (source: Deutscher Kaffeeverband, ICO).

- Where Germany Imports Coffee from

According to Deutscher Kaffeeverband (using Destatis/Eurostat trade data):

Ranking based on Country Share of Importation:

1 – Brazil ~40% Arabica-dominated, price anchor

2 – Vietnam ~15–16% Robusta leader

3–5 Honduras, Colombia, Uganda ~4–6% each Arabica / specialty / Robusta

➡️ Vietnam is already Germany’s #2 supplier, but mainly positioned as volume Robusta

- Form of Coffee Imported into Germany

According to Deutscher Kaffeeverband (using Destatis/Eurostat trade data), 95% of imports are green (raw) coffee beans.

After green coffee arrives (mostly via Hamburg, Europe’s largest coffee port), the German supply chain will handle storage & trading (commodity traders, houses), roasting (industrial + specialty roasters), further processing like: ground coffee, Capsules / pads and instant coffee, then re-export across Europe.

➡️ A large share of coffee imported into Germany is processed and then exported again.

For Vietnamese exporters:

Germany is not just a buyer, but a gateway to Europe.

Vietnam already plays a critical role—but future growth depends on moving from volume-only Robusta to reliability, certification, and partnership-driven supply.

Consider: Direct trade models and Long-term supply contracts (risk-sharing)

Target business: German roasters (private label, B2B) and Importers serving EU-wide distribution

Key sources: Deutscher Kaffeeverband (German Coffee Association), Destatis (German Federal Statistical Office), International Coffee Organization (ICO)

Common Company & Business Forms for Foreign Investors Entering Germany

4 Jan 2026

Disclaimer: This overview is provided for general information purposes only and does not constitute legal, tax, or investment advice. It does not take into account individual circumstances, and no liability is assumed. Professional advice should be obtained before making any business or investment decisions.

Choosing the right legal form depends on capital availability, risk exposure, speed of entry, and long-term business objectives. Below is an overview of the most common and practical options for foreign investors, not to aim to provide a list of all available forms (some of which are OHG, Kommanditgesellschaft and GmbH & Co. KG).

GmbH (Gesellschaft mit beschränkter Haftung)

Best for: serious, long-term market entry

• Pros: Limited liability; strong credibility with banks, customers, and authorities; flexible shareholder structure

• Cons: €25,000 share capital (minimum €12,500 payable upon formation); higher setup and ongoing compliance costs

• Typical use: Operating businesses, manufacturing, sales, and services

• Indicative timeline: ~4–8 weeks (depending on banking and notarization)

The GmbH is widely regarded as the standard and most defensible structure for foreign investors.

UG (haftungsbeschränkt) – “Mini-GmbH”

Best for: early-stage market testing or pilot projects

• Pros: Limited liability; can be formed with very low share capital (from €1 in theory)

• Cons: Lower market credibility; mandatory retention of 25% of annual profits until €25,000 share capital is reached

• Typical use: Pilot projects, startups, initial market entry

• Indicative timeline: ~3–6 weeks

In practice, higher initial capital is usually required for banking and operational reasons. The UG is generally considered a temporary structure, often with a planned conversion into a GmbH.

Branch Office (Zweigniederlassung)

Best for: foreign companies seeking direct operational presence without forming a subsidiary

• Pros: No share capital requirement; direct integration into the parent company

• Cons: Parent company is liable with all its global assets, not only German assets;

• Typical use: Sales or service extensions of an existing foreign company

• Indicative timeline: ~4–6 weeks

A branch office must be registered and may conduct business in Germany. The unlimited parent liability is often a key decision factor for foreign boards.

Bottom line

• GmbH: Best balance of credibility, flexibility, and risk protection

• UG: Low-cost entry for testing the market, with structural limitations

• Branch Office: Faster entry, but significantly higher liability and tax exposure (not a common choice)

For most foreign investors planning to operate in Germany, GmbH or UG are the most practical and defensible choices.

Is there something like a “Representative Office”?

German law does not recognize a representative office as a formal legal entity. The term “Representative Office” is an informal business practice, not a statutory company form.

In practice, it is usually implemented as:

• A non-commercial presence

• Activities strictly limited to market research and liaison functions

• Pros: Low cost; minimal setup

• Cons: No commercial activity allowed; no revenue generation; not registrable in the Commercial Register (Handelsregister)

Note on other business forms

Germany also offers other structures such as partnerships, joint ventures, and corporate forms like AG or SE. These may be relevant in specific scenarios but are not suitable for most small businesses or companies in an early exploration phase.